vermont income tax brackets

The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. Vermont Income Tax Brackets.

Vermont Income Tax Calculator Smartasset

W-4VT Employees Withholding Allowance Certificate.

. This form is for income earned in tax year. The tax rates are broken down into groups called tax brackets. 2023 Vermont Tax Tables with 2023 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

This form is for income earned in tax year 2021 with tax. This marginal tax rate means that. Tax Bracket Tax Rate.

Vermont Single Tax Brackets TY 2021 - 2022. Vermont State Personal Income Tax Rates and Thresholds in 2023. More about the Vermont Tax Tables.

As you can see your Vermont income is taxed at different rates within the given tax brackets. We last updated Vermont Tax Rate Schedules in March 2022 from the Vermont Department of Taxes. Income tax is a tax that is imposed on people and businesses based on the income or profits that they earned.

More about the Vermont Tax Rate Schedules. Vermont has four tax brackets for the 2021 tax year which is a. 4 rows Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018.

5 rows The Vermont income tax has four tax brackets with a maximum marginal income tax of. Are you considering moving or earning income in another state. 4 rows Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax.

Vermont School District Codes. Compare your take home after tax and estimate. Your average tax rate is 1198 and your marginal tax rate is 22.

We last updated Vermont Tax Tables in March 2022 from the Vermont Department of Taxes. Any income over 204000 and 248350 for. Use this tool to.

Vermont Income Tax Return. More about the New York Income Tax. CO-414 Estimated Tax Payment Voucher.

These taxes are collected to provide essential state functions resources and programs to. Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. Vermont Tax Brackets for Tax Year 2020.

PA-1 Special Power of Attorney. The major types of local taxes collected in Vermont include income property and sales taxes. If you make 70000 a year living in the region of Vermont USA you will be taxed 12902.

Detailed Vermont state income tax rates and brackets are available on this page. Pay Estimated Income Tax by Voucher. Pay Estimated Income Tax Online.

Vermont Income Taxes. BA-403 Application for Extension of Time to File Vermont CorporateBusiness Income Tax Return CO-414 Estimated Payment Voucher. The state income tax rate in Vermont is progressive and ranges from 335 to 875 while federal income tax rates range from 10 to 37 depending on your income.

Vermont also has a 600 percent to 85 percent corporate income tax rate. What is the Single Income. More about the Vermont Income Tax.

PA-1 Special Power of Attorney. IN-111 Vermont Income Tax Return.

Vermont Sales Tax Calculator And Local Rates 2021 Wise

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

New Report Vermont S Tax System Is Among The Least Regressive Public Assets Institute

Vermont State Tax Tables 2022 Us Icalculator

Vermont Income Tax Calculator Smartasset

Vermont Tax Brackets And Rates 2022 Tax Rate Info

Utah Income Tax Rate And Brackets 2019

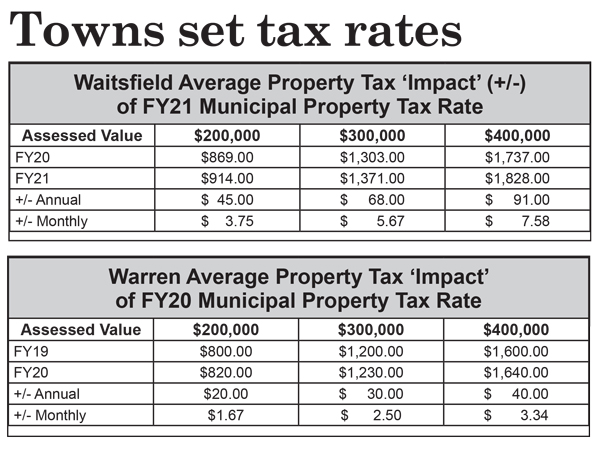

Pai Vermont School Funding Questions Answered Vermont Business Magazine

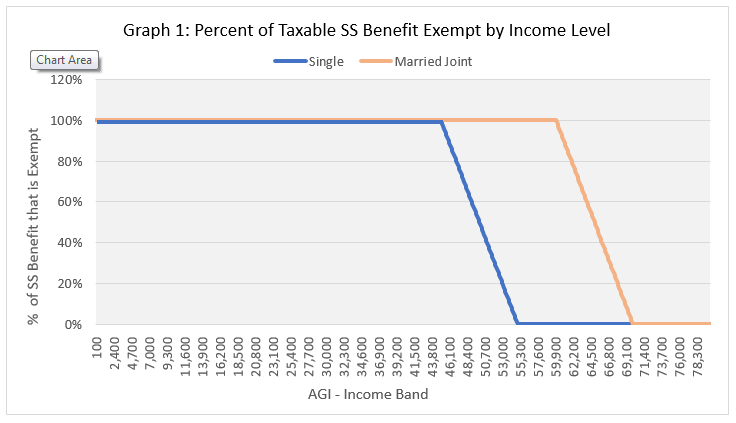

Social Security Exemption Department Of Taxes

States With The Highest Lowest Tax Rates

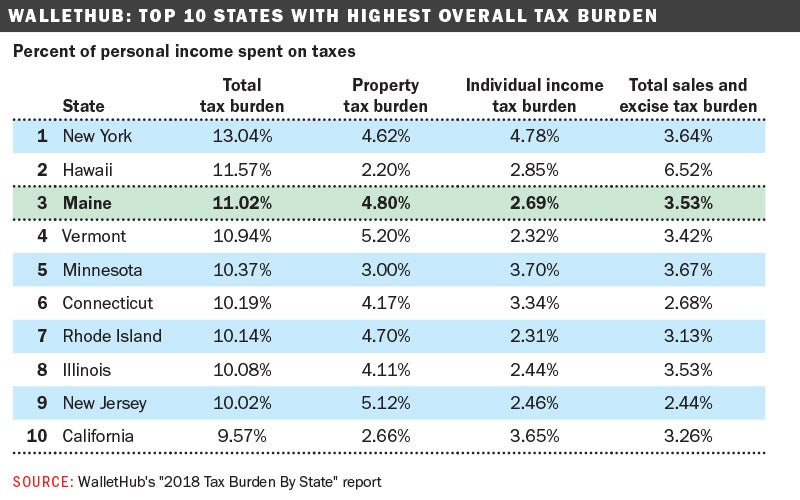

Maine Makes Top 5 In States With Highest Tax Burden Mainebiz Biz

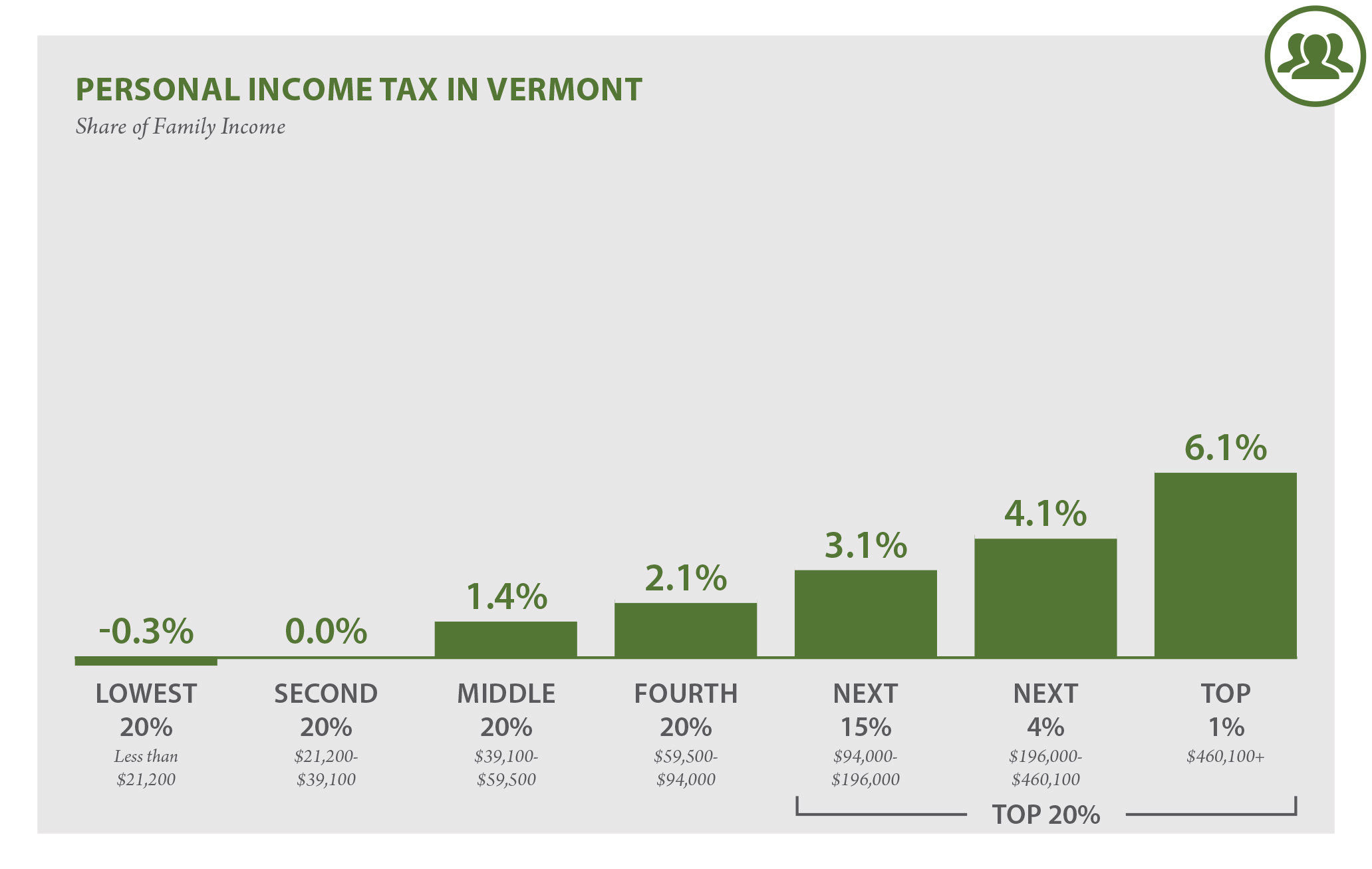

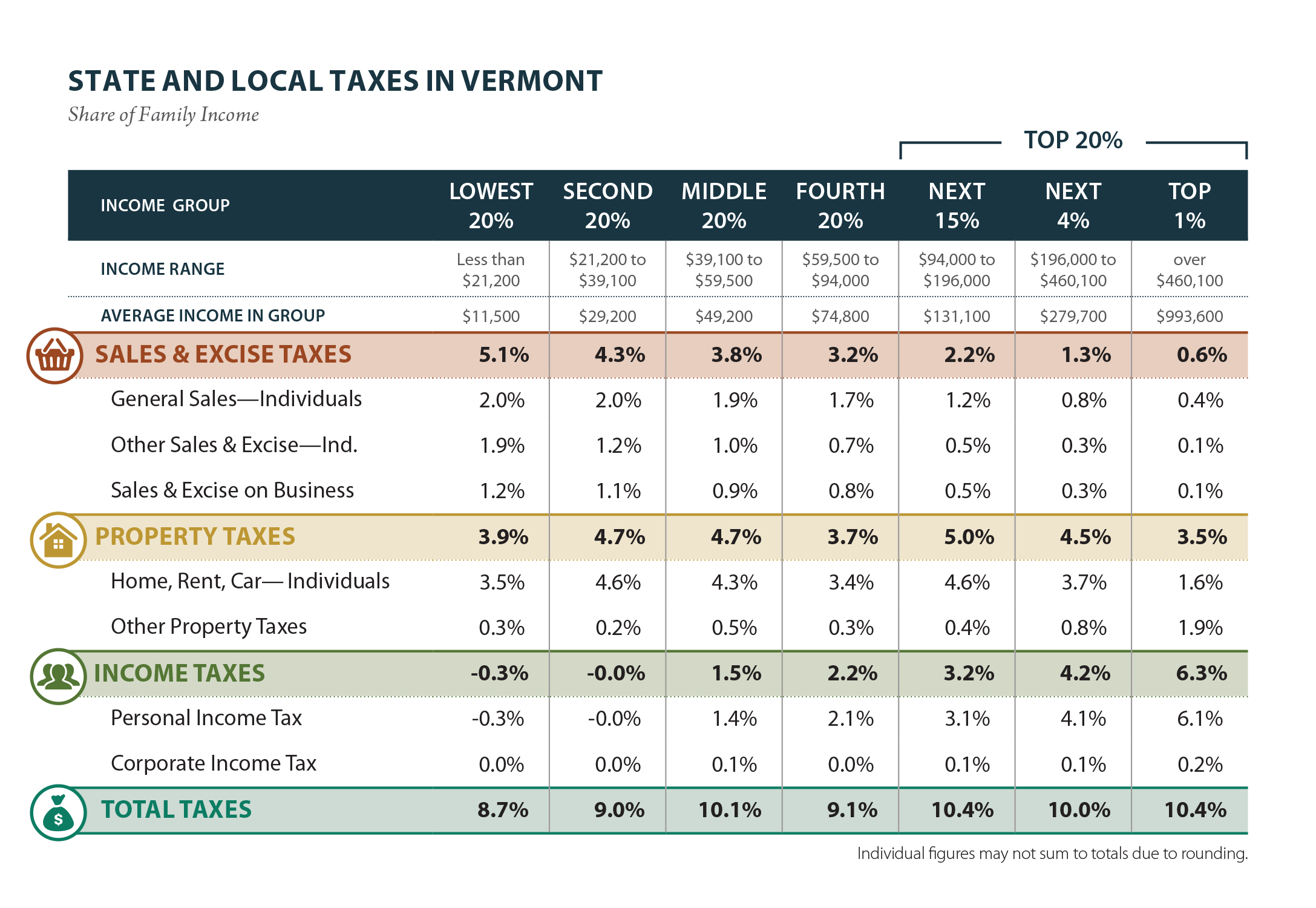

Vermont Who Pays 6th Edition Itep

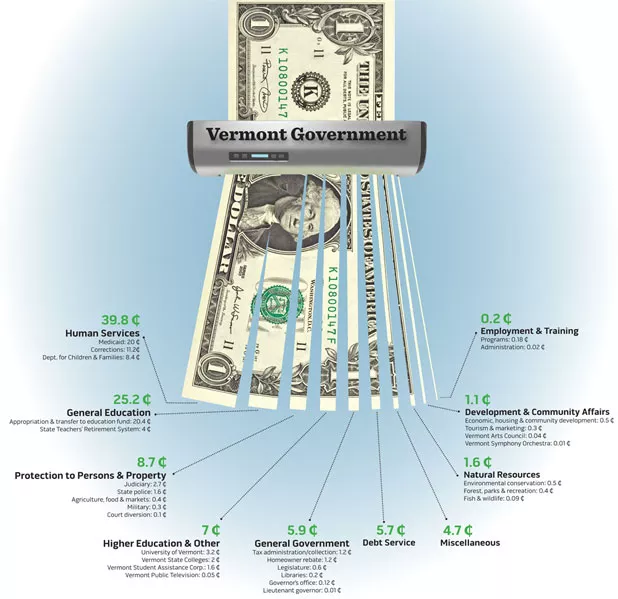

Where Do Your Vermont Income Tax Dollars Go Politics Seven Days Vermont S Independent Voice

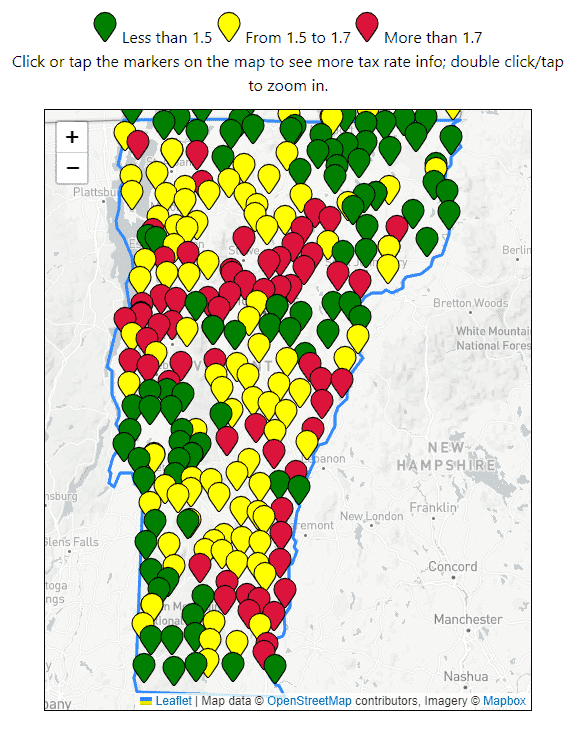

Vermont Education 2021 Property Tax Rates By Town On A Map

Vermont Has The Capacity To Avoid 2016 Budget Cuts Public Assets Institute

Vermont Who Pays 6th Edition Itep

What Is Behind Montpelier S Property Tax Rate The Montpelier Bridge